Business Insurance in and around Scarborough

Scarborough! Look no further for small business insurance.

No funny business here

State Farm Understands Small Businesses.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer stumbles and falls on your property.

Scarborough! Look no further for small business insurance.

No funny business here

Cover Your Business Assets

Being a business owner requires plenty of planning. Since even your brightest plans can't predict product availability or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like a surety or fidelity bond and worker's compensation for your employees. Terrific coverage like this is why Scarborough business owners choose State Farm insurance. State Farm agent Michelle Raber can help design a policy for the level of coverage you have in mind. If troubles find you, Michelle Raber can be there to help you file your claim and help your business life go right again.

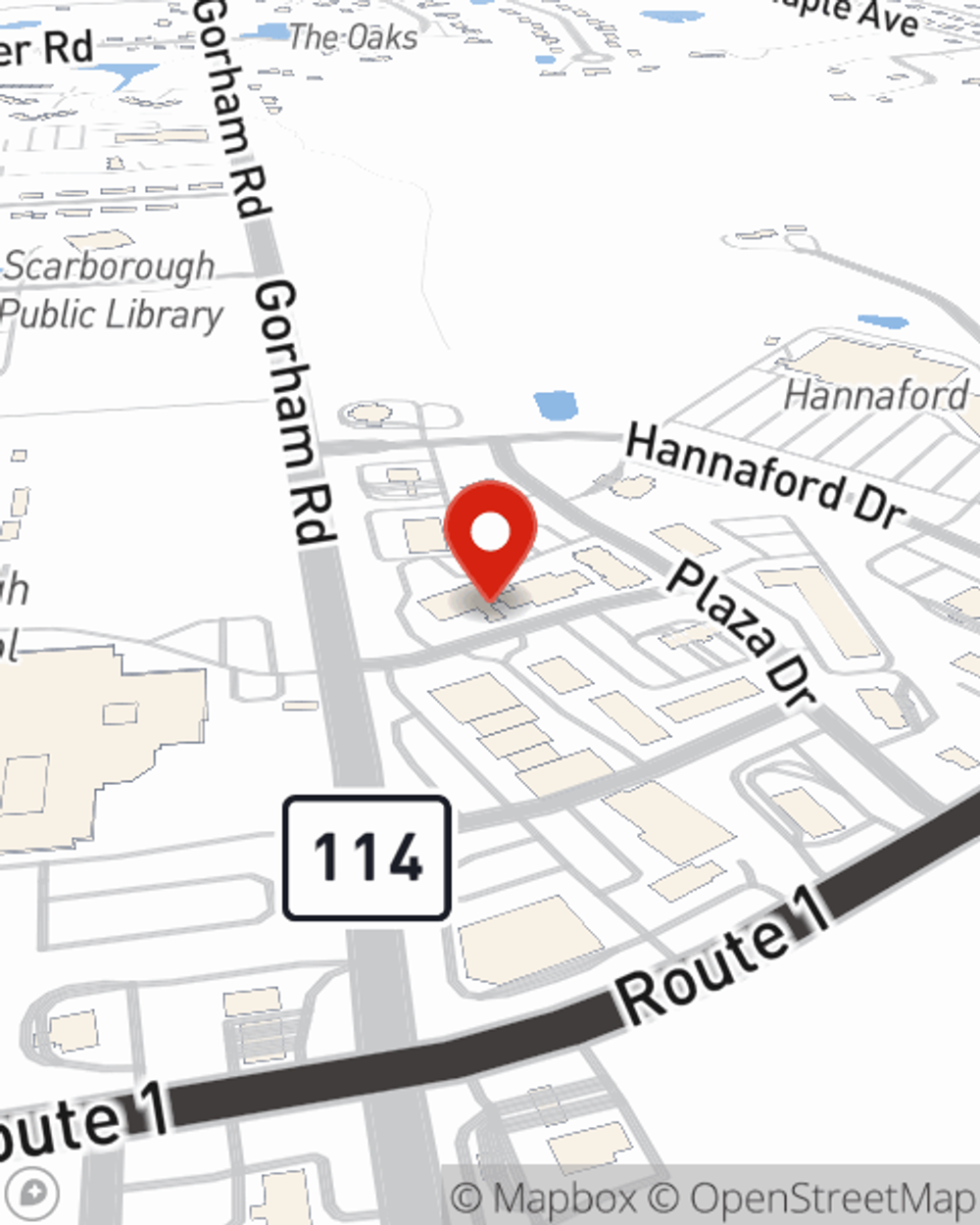

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Michelle Raber today to explore your business insurance options!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Michelle Raber

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.